A continuation of the summer rally was expected last week after some initial weakness and more or less followed expectations with up then down days Mon & Fri, while Tue-Thur rallied with a gain of about 3% for the week. Other CBs are following the Fed with the EU making a "surprise" 0.5% hike (now 0% after being negative for 8 yrs) that seemed to spark a rally in risk assets as the US $ fell. Next weeks FOMC may see a similar positive response as markets seem to be on an "Alice in Wonderland" mood where higher rates now mean lower rates later.

Overall sentiment seems to be moving toward the Sell side, but the recent move in the SPX above the 50D SMA (3920) is likely to provide ST support and similar occurrences in Feb and June saw two week trading ranges.of about 150 pts (Feb/above, June below) before a continuation of the decline. Two important considerations for the INT are the concerns over capitulation and recession. This week in the Tech/Other section, I examine a couple of very LT indicators that show capitulation may be high compared to the "easy money" period of 2018-22 but not to normal periods since 2000. An update of the ST VIX call indicator is included. Next week, I will examine some recession possibilities.

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. 1st is the SPX and ETF put-call indicators (30%), 2nd the SPX 2X ETF INT ratio (40%), and 3rd a volatility indicator (30%) which combines the options volatility ratio of the ST SPX (VIX) to the ST VIX (VVIX) with the UVXY $ volume.

Update Alt. In this case the wts for the SPX 2X ETF ratio (SDS/SSO) and SPX puts & calls spread are adj to equal as in the DM/SM section for SPX ETFs. Volatility sentiment continues to be modestly positive, while SPX ETF vs options sentiment remains at opposite extremes.

Update Alt EMA. Sentiment continues to drop toward neutral and lower levels are likely before a sizable pullback. The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the UVXY $ Vol/SPX Trend. Weights are 80%/20%.Update. ST sentiment dropped to the early June level where a two week consolidation was seen before continuation of the decline.

Update EMA. A sharp decline in sentiment Wed/Thur on the SPX move over 3950 may be following the pattern of early June. The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.

Update EMA. This indicator is quickly approaching levels seen at the Apr-May and June SPX highs.

Bonds (TNX). Bearish sentiment in bonds rose sharply this week and may be preparing for a break below the 38% retracement level at 2.75%. If so, this weeks Sept TLT OI represents "smart money". For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.Update. Bearish sentiment continues to rise.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Update. Easily the most bearish INT indicator, this indicator is quickly approaching the Sell level, now at the lowest level since the Jan decline.

With the sister options Hedge Spread bearish sentiment as a ST/INT indicator (outlook 1-3 mns), sentiment is modestly above neutral. For the SPX, I am switching to hybrid 2X ETFs plus SPX options. Taking a look at the INT term composite (outlook 2 to 4 mns) as bearish sentiment, components remain at extreme opposites with the composite slightly above neutral.For the NDX combining the hybird ETF options plus NDX 3X ETF sentiment with the interest rate effect, (outlook 2 to 4 mns) bearish sentiment shows similar extremes between ETF and options as in late 2020 which resulted in a choppy market until options sentiment rose. Note QQQ options are optimal, but are N/A and are included in ETF options.

Update. Bearish sentiment rose with the late pullback, now nearing a Buy.

III. Options Open Interest

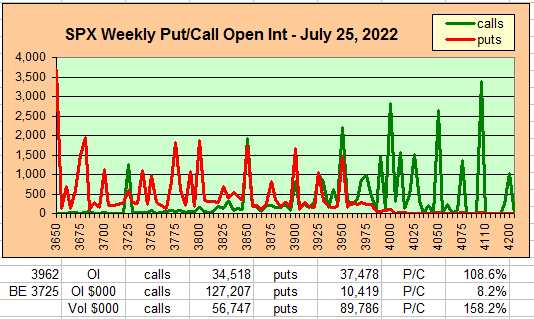

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru July 29. A text overlay is used for extreme OI to improve readability, P/C is not changed. Also, this week includes a look at the GDX for Aug exp & TLT for Sept. A new addition is added for OI $ amounts with breakeven pts (BE) where call & put $ amounts cross plus $ volume.

With Fri close at SPX 3962, options OI for Mon is very small and straddles at 3925 and 3950 may contain prices.

Wed has smaller OI where SPX with most of the puts and calls far OTM, possibly to hedge huge price moves with the FOMC decision and direction is likely to align with the much larger Fri OI.

For Fri strong OI with huge put support at SPX 3910. Hedges at 3950 and 4000 net out much of the call resistance to higher prices and a move over 4000 is possible intraday. Close is likely near 4000.

Using the GDX as a gold miner proxy closing at 25.4, there is strong put support at 25 and the large straddle at 28 may attract prices to the 27-8 area..

Currently the TLT is 118.5 with the TNX at 2.78%, early in the year I noted that large put positions contra to ETF sentiment may be "smart" money and this may be the same for calls. TLT 120 is about TNX 2.75% and 125 about 2.5%.

IV. Technical / Other

First a quick update of the ST VIX call indicator shows continued movement toward the Sell level and volatility may continue to rise.

Next, I use the NY down volume/declining issues as a measure of capitulation (NYDNV/NYDEC). and looking at the last 5 years, it matched the highs seen in early 2018, but when compared to the period since 2000, we see that it also matches the SPX 2001 low about half way thru the 2000-02 bear market. In both cases, there is also a larger trend upwards from the mid 1990s and mid 2010s.

A second LT indicator of positive money. flows is the NYUPV/NYDEC or NY volume advancing to declining. Here, we strong money flows similar to that off the Dec 2018 lows. However, from a historical perspective the more relevant comparison may be the first half of 2008. In this case after surviving the Covid pandemic and the resulting stock market performance, retail investors feel invincible (with most not even aware of what it was like during the inflationary 1970s), while in the first half of 2008, investors had lived thru the dot-com crash and 2002s 09/11 terrorist attack and also felt invincible.

Conclusions. The summer rally may be nearing a close with the possibility of extending thru early Aug. Its now looking like the following correction may extend into Sept with the expected relief from lower inflation being delayed. ST accelerated inflation likely in food supplies due to recent drought and extreme heat extending into the Fall may offset the effects of lower fuel prices. ST/INT sentiment is aligning for a sizeable pullback, possibly to retest the June lows (SPX 3640), but a couple of weeks of upside momentum is likely to persist as long as the SPX remains above the 50D SMA at 3920.

Weekly Trade Alert. A trading range of about 150 SPX pts (3925-4075) is expected thru the first week Aug. Some weakness to SPX 3925-3950 may be seen early in the week but a test of 4000+ is likely by Fri. FOMC on Wed and APPL EPS on Thur may result in large moves. Updates @mrktsignals.

Investment Diary, Indicator Primer, Tech/Other Refs,

update 2021.07.xx Data Mining Indicators - Update, Summer 2021,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2022 SentimentSignals.blogspot.com

No comments:

Post a Comment