I had been expecting a mild pullback last week to about SPX 4000, but apparently underestimated the strength of selling due to Wall Street bears calling for a recession in 2023 and recommending buying bonds and selling stocks. As a result, the SPX fell more than expected to 3920 and bonds rallied more than expected, with the TNX briefly falling to 3.4%. The week ending PPI disappointment, however, dispelled the bond rally with the TLT falling 2%+ and the TNX moving back to 3.6%. Weakness in bonds later in the day also spooked stocks with a close near the weekly low. SPX options OI is now showing little support for a rally next week with a range around current levels likely.

The Tech/Other section is a fedzilla where the Wall Street mantra for a recession in 2023 H1 due to the 10 Yr - 3 Mn Treasury curve is questioned by data from the St Louis and NY Fed that show that a recession is more likely in 2023 H2 and that int rates are likely to keep rising until unemployment rises.

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. 1st is the SPX and ETF put-call indicators (30%), 2nd the SPX 2X ETF INT ratio (40%), and 3rd a volatility indicator (30%) which combines the options volatility ratio of the ST SPX (VIX) to the ST VIX (VVIX) with the UVXY $ volume.

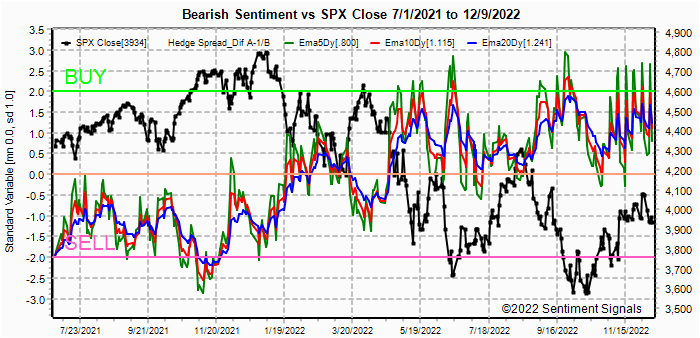

Update Alt. In this case the wts for the SPX 2X ETF ratio (SDS/SSO) and SPX puts & calls spread are adj to equal as in the DM/SM section for SPX ETFs. Bearish sentiment has reached the level of Jan 2022 and any upside is likely to be very limited.

Update Alt EMA. EMAs seem to be showing a declining trend and a topping pattern similar to Nov-Dec 2021 may be forming. The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the UVXY $ Vol/SPX Trend. Weights are 80%/20%.Update. Bearish sentiment has now reached neutral but may rise further before a rally.

Update EMA. No sustainable rally is likely.

Update VIX Calls & SPXADP. No update last week, so now is it. This combo continues to generate a lot of signals, and is now at a weak Buy. The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.

Update EMA. Hedging is very volatile supporting every little pullback and will likely limit downside.

Bonds (TNX). Bearish sentiment in bonds has stopped moving lower and a sustained move higher in rates is possible at any time. For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.Update. For the couple of months, I have been looking for a consolidation similar to early 2018 (about 180-220) and both highs and lows were exceeded, but ETF sentiment is now dropping sharply as expected and a move below neutral could set up a collapse to 140 or lower.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Update. Sentiment remains at Sell extremes.

With the sister options Hedge Spread bearish sentiment as a ST/INT indicator (outlook 1-3 mns) indicates continued fear of an imminent decline and is more likely to see a clearing rally before a sustained decline.For the SPX, I am switching to hybrid 2X ETFs plus SPX options. Taking a look at the INT term composite (outlook 2 to 4 mns) as bearish sentiment, options sentiment continues to show a bi-modal market and may be influenced by an increased in trading same-day options. Prolonged topping as late 2021 is possible.

For the NDX combining the hybrid ETF options plus NDX 3X ETF sentiment with the interest rate effect, (outlook 2 to 4 mns) bearish sentiment shows similar extremes between ETF and options as in late 2020 which resulted in a choppy market until options sentiment rose. Note QQQ options are optimal, but are N/A and are included in ETF options.

Update. Combined sentiment is now at the lowest level

since Feb 2021.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Dec 16. A text overlay is used for extreme OI to improve readability, P/C is not changed. Also, this week includes a look at the TLT for Dec exp. A new addition is added for OI $ amounts with breakeven pts (BE) where call & put $ amounts cross.

With Fri close at SPX 3934, options OI for Mon is small, but lack of news could push prices back to the put support at 3950-4000 level.

Wed has smaller OI where SPX has weak put support up to 3950-4000.

For Fri AM strong OI with mostly hedged positions between SPX 3700-4000 may increase dealer incentive to drive prices toward BE at 3930.

For Fri PM moderate OI shows put support up to SPX 3975 and call resistance at 4000.

Currently the TLT is 106.3 with the TNX at 3.57%, the added puts at 105 and 110 may keep prices near current levels, ie, less likely to see 100.

IV. Technical / Other

This week I want to look at several charts from the St Louis and NY Fed. The first chart is just an update of the chart shown a couple of weeks ago. I had selected annual CPI when I wanted monthly annualized so 2022 was not available. So this is the correction.

This is the FRED (St Louis) 10 Year - 3 Mo Treasury yield curve that everyone is using as a "perfect" predictor of recessions with most expecting a sharp recession in 2023H1. Unfortunately the Fred data for 3 Mo starts in 1980 and may work in a secular bull market for bonds, but what about a secular bear market?

I just found this in AM, but the NY Fed has their own recession predictor model based on the same 10 Yr - 3 Mn Treasury spread back to 1960 where their research concluded that there is a 12 month lead time on average after an inversion before a recession (lower chart). This shows that compared to the inflationary 1970s, the inversion is very mild so far and more importantly with the inversion occurring in Oct 2022, a recession is not expected until Oct 2023 (or at least H2). So Wall Streets "buy bonds 2023 H1 and stocks H2" may be reversed.

Here I wanted to look at unemployment rate compared to the ten year yield, specifically that rising rates can lead unemployment by several years, but rising unemployment always precedes a recession in short order. I am looking for something more like the late 1960s where rates continued to rise until unemployment rises. Oddly, averages of both int rates (5.9%) and unempl rates (5.95%) are about the same over this time period.

Here, we see that the 2001-02 and 2008-09 recessions did not occur until after the yield curve un-inverted.

Conclusions. Last week had more excitement than expected, all to the downside, and there doesn't seem to be a lot of indication for much excitement next week. However, with CPI on Tue and FOMC Tue-Wed anything is possible. ST there may be a move back to the SPX 4000 level, but the EOM heavy SPX call position at 3825 may hinder any further advance until early Jan when earnings and "no Fed" until late Jan may provide some breathing room for an advance.

Weekly Trade Alert. A small advance is likely next week early to SPX 3950-4000 with some weakness into Fri AM with SPX OI$ BE at 3930 and then a higher close. Updates @mrktsignals.

Investment Diary, Indicator Primer, Tech/Other Refs,

update 2021.07.xx Data Mining Indicators - Update, Summer 2021,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2022 SentimentSignals.blogspot.com

No comments:

Post a Comment