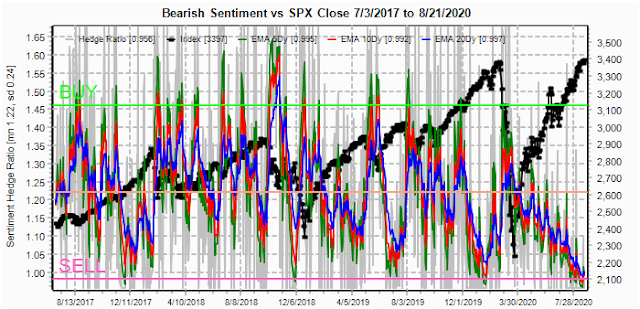

Two weeks ago, I extended the sentiment chart period back to July 2017 to include the move from Aug 2017 (a volatility event) to the Jan 2018 high as an alternate "run to the top", compared to the Oct 2018 and Feb 2020 tops which were preceded by 3% and 6% pullbacks only weeks before the final blow off. Now it appears that price behavior is supporting the "alternate" with the June swoon providing the volatility event. This is supported by sentiment as shown below as the two remaining "less bearish" sentiment indicators - the VXX $ volume, as too many hedgers are looking for a short but sharp decline, and the ETFs as measured by the 2X SPX and NDX ETFs. Several weeks still appear to be remaining before the final two pillars fall.

Last week was somewhat stronger than expected as a move down to the SPX 3350 area indicated by the options OI was accomplished but then immediately reversed, mainly on the back of a 10% rise in AAPL late in the week in anticipation of the 4 for 1 stock split pricing on Mon 24th (likely $500+, split date 31st). The SPX seemed to run into a brick barrier at the 3400 area several times during the week but options OI still indicates that a move to 3400-20 or higher is likely next week,

Late Sept remains as a target for a probable top and the extremes seen in sentiment are warning that the following decline could be more serious than Mar 2020, either in price or time or both. For instance, a 40% decline in 3 to 6 months from SPX 3600 would target the 2160 area.

The overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment has reached a lower level than any time the last three years where INT tops with lower levels semm to indicate increasingly larger declines.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment retreated from its recent spike as both gold and the miners rallied strongly to start the week on news that W. Buffet had purchased a $500+M stake in Barrick Gold, then closed the week near even.

II. Dumb Money/Smart Money Indicators

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 mns/weeks) bearish sentiment continues to make new lows, especially with the LT EMA (blue) well below that of Jan 2020, indicating a more serious decline (lower/longer) is likely.

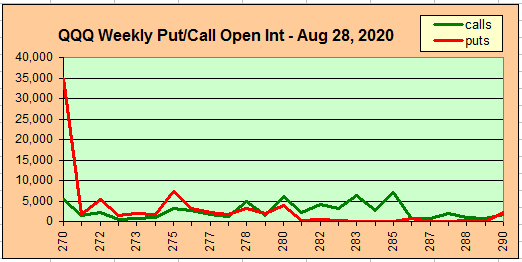

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Aug 31. Also, this week includes a look at the GDX for Sept exp.

With Fri close at SPX 3397, options OI for Mon has relatively small OI, except at 3475, put support is at 3350 while call resistance over 3400 may cause backing and filling to 3375. The calls at 3475 were $.05 Fri aft with someone possibly expecting a stimulus compromise over the WE. A gap up of 30-50 pts would probably cause a 5x to 10x return.

IV. Technical / Other

This week I will look at an update of two of the Equity P/C data mining sentiment indicators. The first is the Equity P/C to SKEW spread which has been following an expandomg wedge since mid-2017 where bearish sentiment leads to larger and higher bearish sentiment leads to larger rallies. If it continues, a decline of 40% or more seems likely.

Investment Diary, Indicator Primer,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2020 SentimentSignals.blogspot.com

No comments:

Post a Comment